The Integrity Report: Uncertainty Reigns Supreme

The Integrity Report: Uncertainty Reigns Supreme

May 4, 2020

By Scott Werdebaugh

“While the crash only took place six months ago, I am convinced we have now passed the worst, and with continued unity of effort, we shall rapidly recover.”

President Herbert Hoover circa 1930

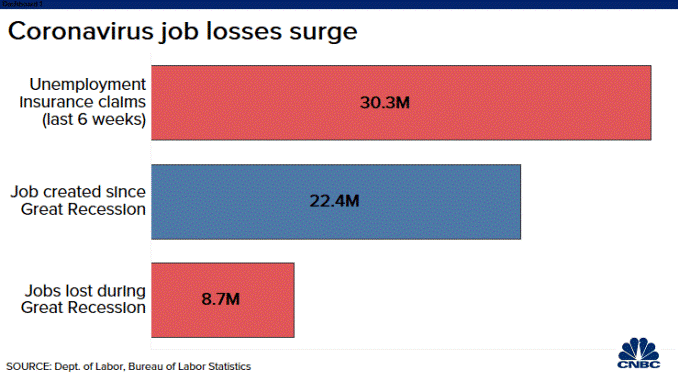

As some states begin to reopen their economies, it seems that many talking heads are forecasting resilient returns to pre-pandemic lifestyles and rates of economic expansion by the fourth quarter of this year. They need to do their homework. We all want to return to how things were just a few months ago, but that is not going to happen. There have been 30.3 Million unemployment claims in six weeks. What many do not understand is that Covid-19 was a nuclear strike to the economy! We just do not just recover from that type of destruction in a few months; it will take a few years at least. Human behavior has changed, business behavior has changed (or closed) and there is much uncertainty as when and how we can return to “normal” life.

The one thing that markets hate the most is uncertainty. They may not like bad news, but there are parameters in place which allow them to interpret the news, make calculated adjustments and develop a plan moving forward. There are no investment models for uncertainty. It is pure speculation and wise investors avoid uncertainty, gamblers do not.

A Wise Investor – Warren Buffett

Berkshire Hathaway chairman Warren Buffett held their annual investors conference this past weekend and gave his perspective on the current economic environment. Mr. Buffet is 89 years old and is renowned as one of the best investors of all time. A large part of his investing philosophy is to build cash reserves and buy at moments when a business needs a cash infusion. He is smart, calculating and notorious for investing in companies during turbulent times in history. During the Great Recession, he invested roughly $3 Billion in GE preferred stock in 2008 and negotiated a 10% annual dividend for three years. This came after investing $5 Billion in Goldman Sachs just eight days earlier. Both investments were with well-known profitable companies that were hit hard by the Great Recession. He knew the bad news, interpreted it, made calculated adjustments for his risk (10% dividend at GE) and helped them develop a plan moving forward.

Warren Buffett made billions from investments made during the Great Recession. It would seem like this would be the perfect scenario for him to invest. Guess what new investments he is making during this recession? NOTHING! That should get your attention. Why? Because there is too much uncertainty in the world right now. No one knows how the economic fallout of Covid-19 is going to play out, not even someone as smart as Warren Buffett. Does this mean that you should not be investing at this time? Not necessarily. Berkshire Hathaway has billions invested currently, but he is waiting to deploy his next billion(s) when the economic environment has more predictable outcomes. Timing is everything.

Mr. Buffett also insinuated that Berkshire Hathaway’s intrinsic value (the value of an asset) had likely decreased by more than 15% during this crisis. Berkshire Hathaway has one of the strongest corporate balance sheets in the world with a AAA Bond rating. If their company value has decreased by more than 15%, what does that say about the rest of the companies that have weaker balance sheets. Think back to our discussion on corporate bond ratings a few weeks ago and remember that there is roughly $3 trillion in BBB and below rated bonds. The corporate bankruptcies are just beginning and the fallout from them is not yet baked into the market, not with it only down 12% from all-time highs.

Market Terminology

Before we proceed, I would like to address a few market terms that may help you understand some of the following commentary.

- Bull Market = an upward trending market. (Stocks rise in value)

- Bear Market = a downward trending market that has decreased at least 20% from the market highs.

- Shorting the Market = purchasing options that pay out when the market goes down.

- Short Covering = the buying of stocks or other securities or commodities that have been sold short, typically to avoid loss when prices move upward.

Market Assessment

The markets were down for the second consecutive week last Friday (5/1/2020) after bouncing off their March lows for several weeks. What factors led to the markets bouncing off their March 2020 lows?

- Hope

- FOMO (Fear of Missing Out)

- Short covering

- Government “stimulus” programs.

My thoughts on these four factors:

- Hope is not a strategy. The market was very expensive at the beginning of this year and toward the end of the longest Bull Market (upward trending market) in US History. It does not make any sense to only be down 12% after experiencing an abrupt economic halt to the economy.

- Investors have developed a “Buy the Dips” mentality as that is what all the “experts” have been telling them for the last 10 years. Buying the dips (downturns in the market) makes sense during a Bull Market, but buying dips in a Bear Market can cost you a lot of time and/or money.

Avoiding losses is the first rule of successful investing and is magnified the closer a

person gets to retirement. Unfortunately, the average buy-and-hold stock market

investor spends 74% of his or her time recovering from downturns in the market

(from 1900 – May 2015)? (Source: Ned Davis Research).

The chart below illustrates the return (Gain Percent) an investor would need to achieve if

they suffered the corresponding loss (Loss Percent).

Our March 2020 market low was a decline of 37% from the February high.Many people believe that they will just need to achieve a gain of 37% to get their account back to its February high value.This is incorrect.They will actually need a 58.74% gain from the March low to grow their account back to its February value.

- The fiercest moves up in the market have historically occurred during Bear Markets rallies mostly due to short covering. By the way, five companies account for 20% of current S&P 500 returns. Historically, that is not a good sign.

- The recently enacted government programs will only mask the economic destruction of Covid-19 for a few months. These programs will not stimulate the economy like those instituted in 2008-09. These programs, such as the Paycheck Protection Program (PPP), simply replaced lost income while others provided desperately needed liquidity to the bond market.

Paycheck Protection Program

In theory, the PPP loans were a great idea by Congress. The basic premise was to

allow business owners to receive low interest loans from the US Government that could

be used for any consecutive eight-week time period between February 15, 2020 and

June 30, 2020. The loans would be fully forgiven if at least 75% of the loan was spent

on payroll while the remaining 25% could be spent on rent, building interest and

employee health insurance. The originators of the bill were seeking a program that

would reduce unemployment and ensure that businesses were fully staffed and

operational if we reopened the economy in the summer. It made sense on the surface

and was embraced by business owners because the loans could be forgiven and they

were told that no taxes would be assessed on the forgiven loan, BUT…………

Once the PPP bill was passed, it was given to various government agencies who were to interpret the bill and provide guidelines. Simply put, the bill gave the agencies too much latitude and it will limit the stimulus on the economy. Here are a few examples as to how the intent of the bill was changed by the government agencies:

- The Small Business Administration (SBA) changed the timeframe which the PPP loan could be utilized. Originally, the proceeds could be used anytime between February 15th through June 30th, but the SBA changed the eight-week timeframe to begin on the date the lender makes the first disbursement of the PPP loan to the business owner.

- The Internal Revenue Service (IRS) confirmed that the PPP loans would not be taxed. However, the IRS stated that if a business owners’ PPP loan is forgiven, the business will not be able to claim the usual business tax deductions for wages, rents and other expenses. In essence, they just eliminated the forgivable loan tax benefit. This announcement came AFTER many business owners had already received their PPP loans.

- Congress enacted a provision of the CARES Act that pays unemployed workers an additional $600 weekly through July 31st. This is on top of their normal unemployment pay. Many small business owners are now having to compete with unemployment wages for employees.

Special Purpose Vehicles (SPVs)

Most of the Federal Reserve’s (the Fed) stimulus programs injected billions of dollars into the bond markets. Markets work because there are buyers and sellers. If no one is buying it is impossible to sell. Companies raise a great deal of their capital through selling corporate bonds (loans). As the economy stopped abruptly (like driving 125 mph into a concrete wall), interest rates plummeted, and no one was buying bonds. Thus, there was no market and no way for these companies to acquire capital which they desperately needed to get through the economic shutdown.

The Fed did the right thing by quickly injecting liquidity into the bond market through several new programs called Special Purpose Vehicles (SPVs). Otherwise, many more businesses would have collapsed, and the unemployment rate would have skyrocketed past the Great Depression level. However, these SPVs did not act as stimulus. The just allowed the markets to function.

Wishful Thinking

A government program that would truly stimulate the economy now and into the future would be to address our decaying infrastructure in the U.S. A massive infrastructure program that would update our roads, dilapidated bridges, airports, train systems, broadband internet, etc. is something that is long overdue and needs to occur if America is to maintain its competitive advantage moving forward. The government could initiate a multitude of public/private partnerships that would put many of the 30+ million unemployed workers back to work with good paying jobs while also providing a platform that could create additional jobs after the projects were completed. Our government would not just be throwing money at a problem, it would be investing in America’s future. Unfortunately, it would likely be a year before this type of program would be initiated. I just do not see Congress working together to pass this type of program before the elections this fall.

Tidbits

- Here is a good tip if you are looking to purchase a stock. Assess if the company’s dividend is sustainable? Many BBB rated companies may cut their dividend to maintain their Investment Grade bond rating. Dropping their bond rating to “Junk” status would hurt the company’s loan ability. Thus, a company that cuts their dividend is likely to hurt their stock price. This is another piece of the economy that is not currently priced into the markets.

- JP Morgan and Wells Fargo no longer accepting Home Equity Line of Credit (HELOC) applications. HELOCs are riskier products for banks during tough economic times because, the lender who made the primary mortgage is first in line to get paid if the house suffers a foreclosure. Many banks are now requiring higher FICO scores (credit scores) and larger down payments for new mortgage loans. You may want to act quickly if you are looking to purchase a new home or increase your HELOC.

Please feel free to share this article with others who you feel would benefit from this information.

Stay safe and healthy my friends!

The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.